mississippi income tax forms

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Before the official 2022 Mississippi income tax brackets are released the brackets used on this page are an estimate based on the previous years brackets.

Form 89 350 Withholding Exemption Certificate Completed By Employee Retained By Employer

Preparation of your Mississippi income tax forms begins with the completion of your federal tax formsSeveral of the Mississippi state income tax forms require information from your federal income tax return for example.

. Box 23058 Jackson MS 39225-3058. Mississippi income tax forms are generally published at the. 2021 Income Tax Return for Single and Joint Filers.

80-155 Net Operating Loss Schedule. Even Social Security income that is taxed at the federal level is exempt from the state tax in Mississippi. 2020 Mississippi State Tax Rate Schedule published by the Mississippi State Tax Commission.

Form 80-100 - Individual Income Tax Instructions. 2021 Voluntary Withholding Request. Are other forms of retirement income taxable in Mississippi.

According to the Mississippi Department of Revenue people with incomes of at least 100000 a year make up 14 of those who pay state income tax and their payments bring in 56 of the income tax. If you underpaid or failed to pay your estimated income tax for the previous tax year you must file form 80-320 to calculate and pay any interest or penalties due. The Senate plan at the end of four years of cuts would cost 316 million a year plus a one-time expense of 130 million its first year for a rebate to taxpayers.

Get W-4P e-File with TurboTax. An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns. If you have not done so already please begin with your federal Form 1040Remember that federal tax forms 1040EZ and 1040A have been discontinued.

Alabama has a state income tax that ranges between 2 and 5 which is administered by the Alabama Department of RevenueTaxFormFinder provides printable PDF copies of 48 current Alabama income tax forms. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face late tax payment. Mississippi tax return forms are available on the Mississippi tax forms page or the Mississippi Department of Revenue.

Arizona has a state income tax that ranges between 259 and 45 which is administered by the Arizona Department of RevenueTaxFormFinder provides printable PDF copies of 96 current Arizona income tax forms. Box 23050 Jackson MS 39225-3050. 2022 Withholding Certificate for Pension or Annuity Payments.

80-108 Itemized Deductions Schedule. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Imposes a progressive income tax where rates increase with income.

Income from pensions 401ks IRAs 403bs SEP-IRAs and 457bs are all. 80-106 IndividualFiduciary Income Tax Voucher REPLACES THE 80-300 80-180 80-107 IncomeWithholding Tax Schedule. Your Federal Income Tax Guide.

80-110 EZ Resident. If you are receiving a refund PO. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. 80-115 Declaration for E-File. Get Publication 17 e-File with TurboTax.

Please reference the Mississippi tax forms and instructions booklet published by the Mississippi State Tax Commission to determine if you owe state income tax or are due a state income tax refund. All other income tax returns P. For all of the tax forms we provide visit our Mississippi tax forms library or the s tax forms page.

11-0001 Form 80-110 - EZ Individual Income Tax Form. Mississippi provides exemptions for retirees on all of the most common forms of retirement income. These numbers are subject to change if new Mississippi tax tables are.

Get W-4V e-File with TurboTax. We would like to show you a description here but the site wont allow us. This coupled with elimination of the 3 tax bracket effective last year would mean people would pay no state income tax on their first 26600 of income.

Mississippi State Tax Forms Printable Fill Online Printable Fillable Blank Pdffiller

Individual Income Tax Forms Dor

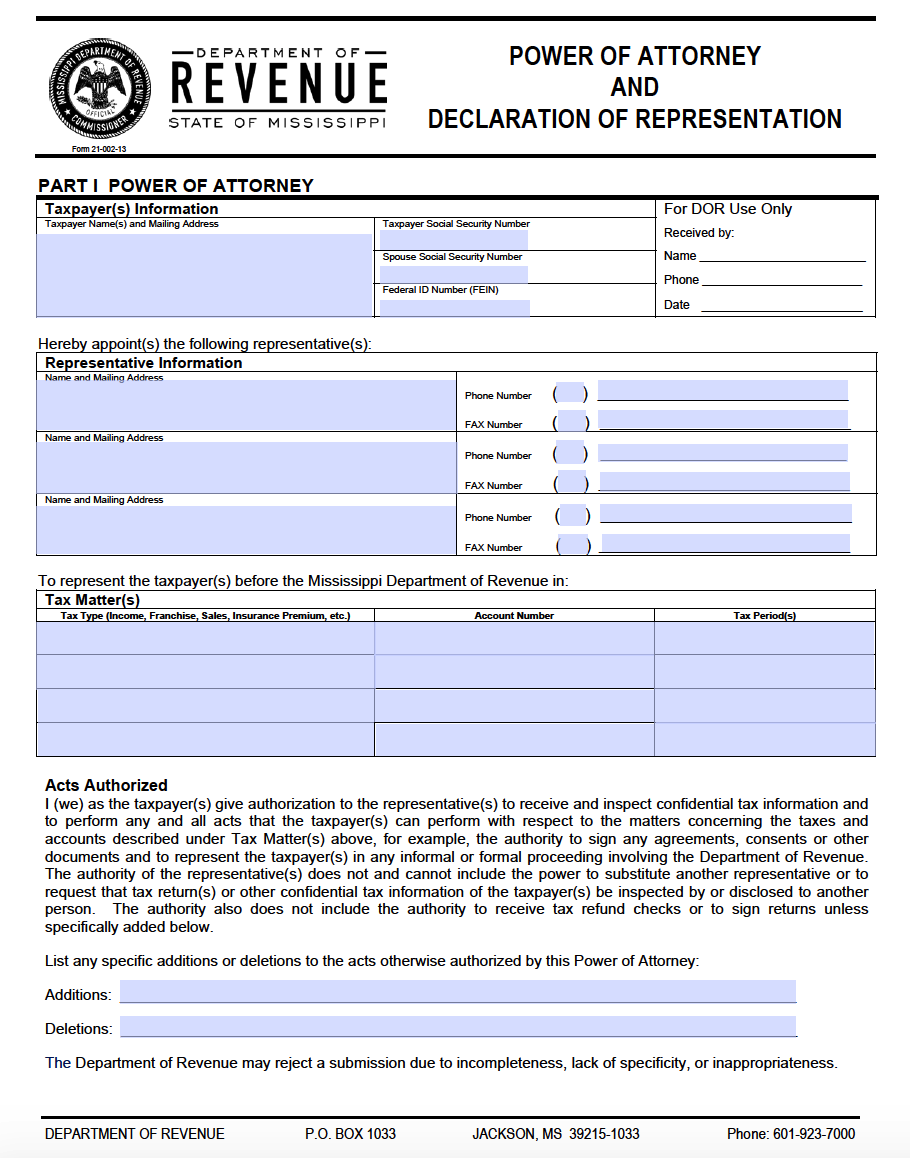

Free Mississippi Power Of Attorney Forms Pdf Templates

Irs Mississippi State Tax Form 80 170 Pdffiller

Mississippi Return Review Notice Sample 1