can you overdraft your bank account with cash app

If a charge comes to your bank and you dont have the funds to cover it the bank will refuse the charge and charge you a bank fee. You can also visit the following link for more details.

Cash App Reviews Read Customer Service Reviews Of Cash App

This puts you in immediate overdraft.

. One of the Cash Apps best features is the ability to add money to your Cash Card balance at any participating retailer. If you have say 40 in your account but use your debit card at the gas pump it will automatically charge your account 70. If one thinks that the existing authorized overdraft isnt enough then the account holder should go and talk to the bank and request a temporary increased overdraft limit.

Tap on Borrow Tap. A 050 decreased deal cost is credited the cardholder when there are not enough funds in the account to. Repay the Instant advance with your next paycheck.

Albert will not reimburse you for overdraft fees that result from a transfer initiated by you. You can apply to add an arranged overdraft to your account and youll only pay daily arranged overdraft interest if you use it. Let us say your OD limit is 10000 and you have used 7000 andyou have given a cheque for 2000.

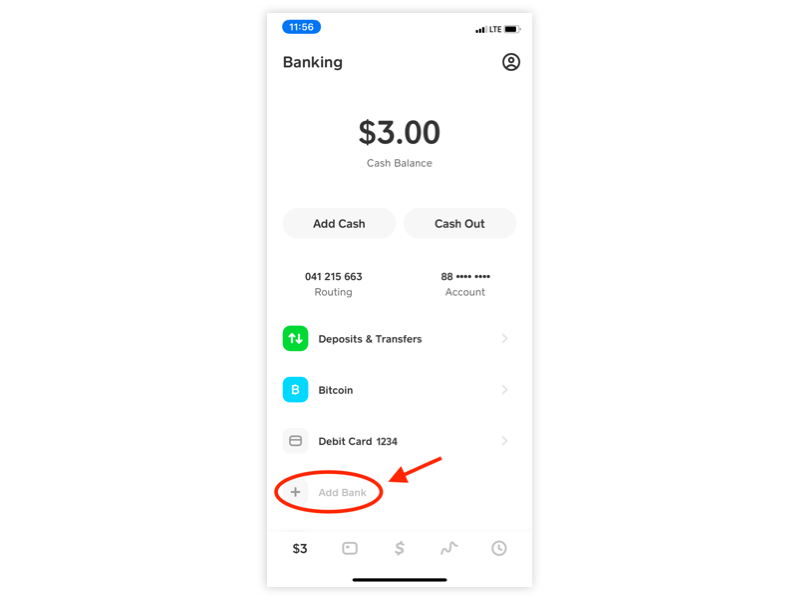

An overdraft occurs when you dont have enough money in your account to cover a transaction and the bank or credit union pays for it anyway. Follow these 10 simple steps for how to borrow money from Cash App. With a Restricted Account you may link an external US-issued bank account an Eligible Bank Account as defined below to make a payment to another Cash App customer including payments made to a Cash for Business Seller defined below and you may transfer funds from your Cash App Balance defined below to your Eligible Bank Account but you will.

If your checking account has insufficient funds for a transaction your bank will automatically attempt to transfer funds from the linked account typically your savings account. We generally post such deposits to Albert Cash accounts on the day they are received which may be up to 2 days earlier than the payers scheduled payment date. Cash App is a peer-to-peer digital wallet that enables customers to make and receive payments instantly.

If you meet the requirements youll have the chance to overdraft up to 200 on transactions. The entity that submitted the charge can also charge you a returned check or returned payment fee. Chases ATM network stretches over 16000 miles and over 4700 branches provide easy access to.

Download to see if you qualify for Albert Instant. How does an overdraft get paid back. When we receive your next.

Please call customer service at 800432. If it is determined that the overdraft fee was caused by one of the above reasons Earnin will reimburse. Yes you can overdraft your account as long as you opt-in to the banks overdraft services.

Your bank or credit union cannot charge you fees for overdrafts on ATM and most debit card transactions unless you have agreed opted in to these fees. How can I overdraft my Bank of America account. No Cash App has no overdraft fee.

You might consider it as the best part of the Cash App. Does Cash App have an overdraft fee. For this overdraft service you pay a fee per transaction usually around 35Without overdraft protection you will have insufficient funds penalties if you write a check and it bounces.

Once you agree to the SpotMe Terms and Conditions you are officially enrolled in SpotMe. The only way to know if you can is to check. Check for the word Borrow If you see Borrow you can take out a Cash App loan.

There will no charge for overdraft fees in your Chase secure banking checking account and when you transfer 100 from another bank you will be eligible. Go to the Banking header. In addition to that Cash App also does not charge penalty or interest over the overdraft amount.

If they have usually managed their account in a responsible manner the bank will usually grant such a request. An arranged overdraft can act as a short term safety net. Qualifying actions may include.

Yes if you still have OD limit and No if you have exhaustedyour OD limit. If you receive an overdraft fee from your bank due to any of the above reasons please contact Earnin Support via chat so that you can upload a screenshot from your bank account showing the Earnin debit s and the related overdraft fee s. Any payments you receive from friends or family will be added to your Cash.

Overdraft protection is straightforward. Overdraft protection links your checking account to another account you have at the bank such as your savings account. Overdraft protection covers you if you spend more money than you have in your account.

You can receive up to 2 reimbursements in total. Youll even receive an alert when youre about to overdraw your. Even if you only get 5 worth of gas because you know your account is getting low the bank will show a 70.

When youre enrolled in SpotMe you will be able to make debit card purchases that overdraft your account up to your limit. Another option is to use Square Cash to receive payments. Overdraft protection is basically an agreement you enter with your bank in which they guarantee payment on your spending up to a certain amount usually a few hundreds bucks.

Just provide your Square Cash direct deposit account details to your employer and you can receive your pay into your Cash App Balance. You can use it to borrow money up to an agreed limit through your bank account. Can you overdraft cash App.

Tap on your Cash App balance located at the lower left corner. The overdraft is paid back to the bank when money is put into your accountIf you do not repay the overdraft in the agreed time it can affect your credit history and make it harder to get loans or overdrafts in future. You can also use the app to pay for products and services at any retail location that accepts them.

Automatic withdrawals from your bank account to your Albert Savings account. Hes definitely using that money for something shady. Money transfer apps like Venmo Zell and Cash App have been growing in popularity during the pandemic -- but 8News has uncovered scammers have found a way with to use Cash App to con you of your cash.

Open the Settings tab in your Chime app to find out if youre eligible for the SpotMe feature make sure you have the latest version of the app. See app for details. You can apply for an overdraft as soon as you open the app.

Instead of overdrawing your. Savings bonus may vary. Another option is to simply get your paycheck deposited in your Square Cash account.

Automatic repayments of Instant or standard advances. Cash back terms apply. Automatic payments of Genius subscriptions.

Cash app can not overdraft if the expense is greater than your balance it declines. The bank will set a time limit for the overdraft to be fully repaid.

Cash App Review 2022 Pros And Cons

Can Cash App Balance Go Overdraft Negative Youtube

Cash App Plus Plus Apk For Android Ios Cash App Claim

2022 Can I Overdraft My Cash App Card At Atm Gas Station Unitopten

Cash App Loan How To Unlock Cash App Borrow Feature

Cash App Reviews Read Customer Service Reviews Of Cash App

Cash App Overdraft Understand When Cash App Balance Go Negative

How To Get Free Money On Cash App Gobankingrates

How To Link Your Lili Account To Cash App

Cash App Plus Plus Apk Download For Android Ios Free Money 2022

Cash App Review Insane Cashback Scams Customer Service Hacks Alternatives Sly Credit

Cash App Plus Plus Apk Download For Android Ios Free Money 2022

Cash App Hack 2021 This Cash App Free Money Tutorial Made Me 500 In 5 Minutes New Youtube

Cash App How To Add Money Without Debit Card Cash App Without Debit Card Or Bank Account Help Youtube

How To Get 500 Free On Cash App Youtube